Luxury car leasing vs buying pros and cons sets the stage for a detailed exploration of the advantages and disadvantages associated with both options. From financial considerations to maintenance responsibilities, this analysis delves into every aspect to help you make an informed decision when it comes to acquiring your dream luxury vehicle.

Introduction to Luxury Car Leasing and Buying

Luxury car leasing refers to a process where an individual or business pays for the use of a high-end vehicle for a specific period, usually 2-4 years, without owning it outright. On the other hand, purchasing a luxury car involves buying the vehicle outright and owning it for the long term.

Process of Luxury Car Leasing

When leasing a luxury car, the individual or business makes regular monthly payments for the use of the vehicle. These payments cover the depreciation of the car during the lease term, along with any additional fees and taxes. At the end of the lease term, the vehicle is returned to the leasing company unless the lessee chooses to buy it outright.

For frequent travelers, the benefits of annual multi-trip travel insurance are undeniable. With this policy, you can save time and money by avoiding the hassle of purchasing insurance for every trip. It offers convenience and comprehensive coverage for all your travels throughout the year.

Process of Purchasing a Luxury Car

When buying a luxury car, the individual or business pays the full purchase price of the vehicle upfront or takes out a loan to finance the purchase. Once the payment is made, the buyer owns the car outright and can keep it for as long as they wish. Maintenance, insurance, and other costs are the responsibility of the owner.

When planning a winter sports holiday, it’s essential to consider getting travel insurance for winter sports holidays. This type of insurance provides coverage for potential risks like injuries on the slopes or lost equipment, giving you peace of mind while enjoying your winter adventure.

Difference Between Leasing and Buying Luxury Vehicles

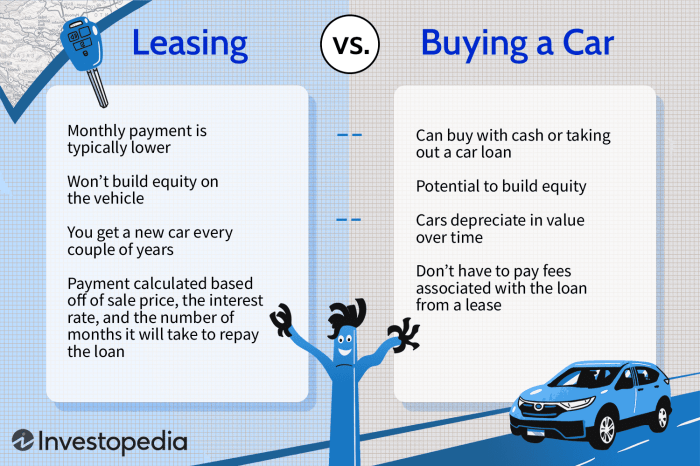

- Leasing allows for driving a new luxury car every few years without the commitment of ownership, while buying provides long-term ownership and potential for customization.

- Leasing typically requires lower monthly payments and may have restrictions on mileage and wear and tear, whereas buying involves higher initial costs but no mileage restrictions.

- Leasing offers the flexibility to upgrade to newer models more frequently, while buying allows for building equity in the vehicle over time.

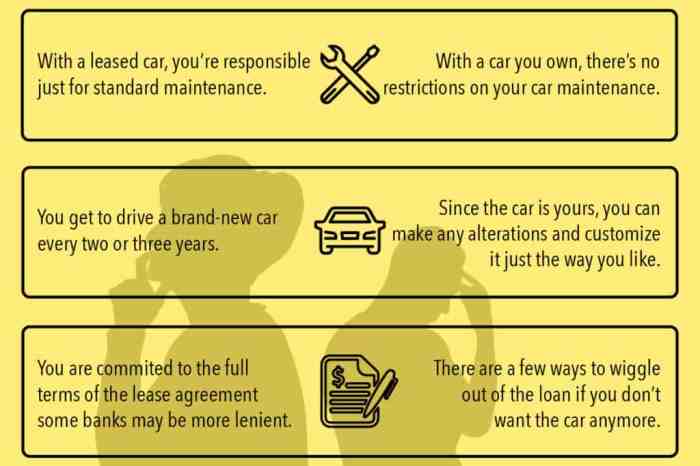

- Leasing involves returning the car at the end of the lease term, while buying allows for selling or trading in the vehicle whenever desired.

Pros and Cons of Luxury Car Leasing: Luxury Car Leasing Vs Buying Pros And Cons

When it comes to leasing a luxury car, there are several advantages and disadvantages to consider. Here, we will explore the pros and cons of opting for a luxury car lease.

Advantages of Leasing a Luxury Car:

- Lower Monthly Payments: Leasing typically requires lower monthly payments compared to buying a luxury car outright.

- Access to Latest Models: Leasing allows you to drive a new luxury car every few years, giving you access to the latest features and technology.

- Lower Repair Costs: Since leased vehicles are usually under warranty, you may have lower repair costs compared to owning a luxury car long-term.

- Tax Benefits: In some cases, leasing a luxury car can offer tax advantages for business owners.

Disadvantages of Leasing a Luxury Car:

- Mileage Restrictions: Most leases come with mileage restrictions, and exceeding these limits can result in additional fees.

- No Ownership: When you lease a luxury car, you do not own the vehicle, and you must return it at the end of the lease term.

- Higher Insurance Costs: Insurance premiums for leased luxury cars can be higher compared to owning a car outright.

- Potential Penalties: Breaking a lease early or returning the car with excessive wear and tear can result in costly penalties.

Examples of Luxury Car Brands with Attractive Leasing Options:

| Brand | Leasing Offer |

|---|---|

| BMW | BMW often offers competitive lease deals on their luxury vehicles, providing attractive terms for lessees. |

| Mercedes-Benz | Mercedes-Benz frequently provides special lease offers on their high-end models, making luxury car leasing more accessible. |

| Audi | Audi offers lease programs that cater to luxury car enthusiasts, with options for various models and packages. |

Pros and Cons of Luxury Car Buying

When it comes to purchasing a luxury car, there are several advantages and disadvantages to consider. Let’s explore the pros and cons of buying a luxury vehicle outright.

Benefits of Buying a Luxury Car

- Ownership: When you buy a luxury car, you have full ownership of the vehicle and the freedom to customize it as you please.

- Prestige: Owning a luxury car can elevate your status and reputation, making a statement about your success and taste.

- No Mileage Restrictions: Unlike leasing, buying a luxury car allows you to drive as much as you want without incurring extra fees for exceeding mileage limits.

- Potential Investment: Some luxury cars hold their value well over time, which could potentially result in a higher resale value if you decide to sell in the future.

Drawbacks of Owning a Luxury Vehicle

- Depreciation: Luxury cars typically depreciate faster than non-luxury vehicles, leading to a significant loss in value over time.

- High Maintenance Costs: Maintaining a luxury car can be costly, as parts and services are often more expensive compared to standard vehicles.

- Insurance Premiums: Insurance rates for luxury cars are generally higher due to their high value and repair costs in case of damage.

- Technology Obsolescence: As new features and technologies are constantly introduced in luxury cars, older models may quickly become outdated.

Long-Term Cost Implications of Purchasing a Luxury Car

Owning a luxury car can result in significant long-term costs beyond the initial purchase price. Factors such as maintenance, repairs, insurance, and depreciation should be carefully considered before buying a luxury vehicle to ensure it aligns with your financial goals and lifestyle.

Financial Considerations

When it comes to deciding between leasing and buying a luxury car, the financial aspect plays a crucial role in making the right choice. Let’s delve into the comparison of financial implications between the two options.

Leasing vs. Buying Costs

- Leasing typically requires lower monthly payments compared to buying a luxury car. This is because you are only paying for the depreciation of the vehicle during the lease term.

- Buying a luxury car involves higher monthly payments as you are financing the total cost of the vehicle.

- Leasing may also include lower down payment and sales tax compared to buying.

Impact on Credit Scores

- Leasing a luxury car can have a different impact on your credit score compared to buying. Since a lease is considered a form of borrowing, it can affect your credit utilization ratio.

- On-time lease payments can help improve your credit score, while missed payments can have a negative impact.

- Buying a luxury car also affects your credit score, but in a different way as it involves a traditional auto loan.

Negotiating Favorable Terms

- Research the market rates and incentives offered by luxury car dealerships before negotiating a lease agreement.

- Focus on negotiating the capitalized cost, money factor, and lease term to secure favorable terms.

- Consider getting multiple quotes from different dealerships to leverage the best deal.

Maintenance and Upkeep

When it comes to luxury car leasing versus buying, maintenance and upkeep are crucial factors to consider. Let’s delve into the responsibilities and costs associated with each option.

Maintenance Responsibilities for Leasing a Luxury Car

- Regular maintenance and servicing are typically covered under the lease agreement, providing peace of mind for the lessee.

- It is essential to follow the manufacturer’s guidelines for maintenance to ensure the vehicle remains in optimal condition throughout the lease term.

- Any repairs or issues that arise during the lease period are typically the responsibility of the leasing company, relieving the lessee of additional costs.

Maintenance Costs for Owning a Luxury Vehicle, Luxury car leasing vs buying pros and cons

- Owning a luxury car involves higher maintenance costs compared to leasing, as all repairs and servicing are the owner’s responsibility.

- Regular maintenance, such as oil changes, tire rotations, and brake inspections, can add up over time, especially for high-end luxury vehicles.

- Unexpected repairs or part replacements can significantly impact the owner’s finances, making ownership more costly in the long run.

Choosing Extended Warranty Options for Luxury Cars

- For both leasing and buying a luxury car, extended warranty options can provide added protection and coverage for potential repair costs.

- When considering an extended warranty, it is essential to weigh the cost against the potential savings on repairs and replacements in the future.

- Extended warranties can offer peace of mind and financial security, especially for luxury vehicles known for their expensive maintenance and repair costs.

Customization and Personalization

When it comes to luxury cars, the ability to customize and personalize the vehicle to fit your unique style and preferences is a crucial factor to consider. Whether you choose to lease or buy a luxury car, the options for customization can vary significantly.

Limitations of Customizing a Leased Luxury Car

When you lease a luxury car, you may encounter restrictions on the extent of customization you can make to the vehicle. Most leasing agreements require the car to be returned in its original condition at the end of the lease term. This means that any modifications or customizations you make to the car could result in additional charges or fees.

- Leasing agreements often prohibit permanent alterations such as custom paint jobs, aftermarket modifications, or changes to the interior of the vehicle.

- Customizing a leased luxury car could potentially decrease its resale value, as future buyers may not appreciate or value the modifications.

- It is essential to carefully review the terms of your lease agreement to understand what customizations are allowed and the potential consequences of making alterations to the vehicle.

Freedom to Personalize a Purchased Luxury Vehicle

On the other hand, purchasing a luxury car offers you the freedom to personalize the vehicle to your heart’s content. When you own the car outright, you can make any modifications or customizations you desire without worrying about violating a lease agreement.

- Buying a luxury car allows you to customize the vehicle to your exact specifications, from selecting the paint color to upgrading the interior features.

- You have the flexibility to invest in high-end aftermarket modifications or accessories to enhance the performance or aesthetics of the car.

- Personalizing a purchased luxury vehicle can create a unique driving experience tailored to your preferences and style.

Resale Value Implications of Customized Luxury Cars

When it comes to resale value, customized luxury cars may not appeal to a broad range of buyers. While some modifications can increase the value of a vehicle, others may limit its marketability and appeal.

- Custom paint jobs, extensive modifications, or unconventional upgrades could deter potential buyers and impact the resale value of a luxury car.

- Buyers may be hesitant to purchase a customized vehicle if the modifications do not align with their taste or preferences.

- It is important to consider the potential resale value implications of customizing a luxury car, especially if you plan to sell or trade-in the vehicle in the future.

Last Recap

In conclusion, weighing the pros and cons of luxury car leasing versus buying allows you to tailor your decision to your individual preferences and financial circumstances. By understanding the nuances of each approach, you can confidently navigate the world of luxury automotive ownership with clarity and insight.