Affordable luxury car financing options present a unique opportunity to drive your dream car without breaking the bank. From understanding different financing types to negotiating the best deals, this guide covers everything you need to know to make your luxury car dreams a reality.

Luxury car enthusiasts, buckle up as we delve into the world of affordable financing options for your favorite high-end brands.

Understanding Affordable Luxury Car Financing

When it comes to purchasing a luxury car, affordability is often a concern for many buyers. Affordable luxury car financing refers to the various financing options available that make owning a luxury vehicle more accessible and budget-friendly.

When traveling, it’s essential to consider getting travel insurance for lost baggage protection to ensure peace of mind. This type of insurance can help cover the cost of replacing lost or stolen luggage, making your trip hassle-free.

Luxury Car Brands with Affordable Financing Options

Several luxury car brands offer competitive financing options to make their vehicles more attainable for a wider range of customers. Some examples of luxury car brands that provide affordable financing include:

- Audi: Audi offers low APR financing deals and lease specials on select models, making it easier for customers to finance their dream car.

- BMW: BMW frequently offers special financing rates and incentives for qualified buyers, allowing them to drive home in a luxury vehicle with a more manageable payment plan.

- Mercedes-Benz: Mercedes-Benz provides various financing options, such as lease programs and low-interest loans, to make their luxury cars more affordable.

Benefits of Choosing Affordable Financing for Luxury Vehicles

Opting for affordable financing when purchasing a luxury car can offer several advantages, including:

- Lower Monthly Payments: Affordable financing options often come with lower interest rates and extended loan terms, resulting in more manageable monthly payments.

- Access to Higher-End Models: With affordable financing, buyers can access higher-end luxury car models that may have been out of reach without financial assistance.

- Improved Cash Flow: By spreading out the cost of a luxury vehicle over time, affordable financing helps preserve cash flow and allows buyers to allocate funds to other priorities.

Types of Financing Options Available

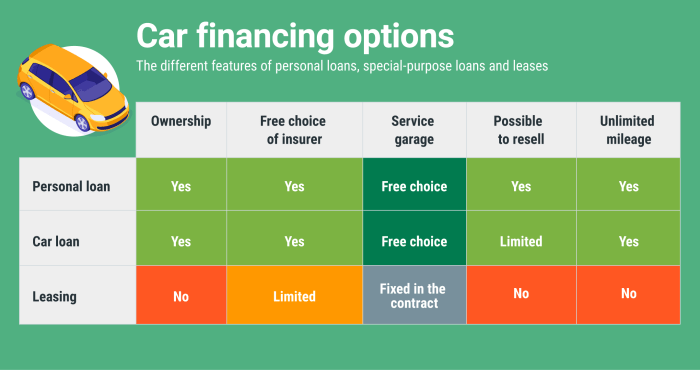

When it comes to financing a luxury car, there are several options available to consumers. Each financing option comes with its own set of pros and cons, as well as specific eligibility criteria that must be met. Let’s take a closer look at the different types of financing options for luxury cars.

Lease Financing

Lease financing allows you to essentially rent a luxury car for a specified period, typically 2-4 years. Pros of lease financing include lower monthly payments compared to buying, the ability to drive a new luxury car every few years, and the potential for tax deductions if the vehicle is used for business purposes. However, cons include mileage restrictions, potential fees for excess wear and tear, and the fact that you do not own the vehicle at the end of the lease.

Loan Financing

Loan financing involves borrowing money from a lender to purchase a luxury car outright. Pros of loan financing include ownership of the vehicle once the loan is paid off, the ability to customize the car as desired, and no mileage restrictions. However, cons include higher monthly payments compared to leasing, the possibility of owing more than the car is worth if it depreciates quickly, and the need for a down payment.

Manufacturer Financing

Manufacturer financing is offered directly by the car manufacturer or through its affiliated financing company. Pros of manufacturer financing include special incentives and low interest rates offered by the manufacturer, as well as the convenience of financing the vehicle at the dealership. However, cons include limited flexibility in terms of loan options, potential requirements for a high credit score, and the possibility of being limited to purchasing a new car from that specific manufacturer.

These are just a few of the financing options available for luxury cars, each with its own advantages and considerations. It’s essential to carefully consider your financial situation and goals when choosing the right financing option for your luxury vehicle purchase.

Factors Influencing Financing Rates

When it comes to luxury car financing, there are several key factors that can influence the interest rates you may be offered. Understanding these factors can help you secure the best possible financing options for your dream luxury car.

Credit Score

Your credit score plays a significant role in determining the interest rate you will be offered for luxury car financing. Lenders use your credit score to assess your creditworthiness and determine the level of risk involved in lending to you. A higher credit score typically translates to lower interest rates, as it demonstrates a strong history of responsible credit management.

Loan Term

The length of your loan term can also impact the interest rate for luxury car financing. In general, shorter loan terms tend to come with lower interest rates, as lenders are taking on less risk over a shorter period of time. However, it’s important to consider your budget and financial goals when choosing a loan term, as longer terms may offer more manageable monthly payments.

Down Payment

The size of your down payment can influence the interest rate for luxury car financing. Making a larger down payment can help reduce the amount you need to finance, which may result in a lower interest rate. Additionally, a larger down payment can demonstrate your commitment to the purchase and reduce the lender’s perceived risk.

Tip: To secure lower interest rates for luxury car financing, focus on improving your credit score, choosing a shorter loan term, and making a larger down payment.

Negotiating Tips for Affordable Luxury Car Financing

When it comes to securing affordable luxury car financing, negotiations play a crucial role in getting the best deal possible. Here are some key strategies to keep in mind when negotiating with dealerships:

Research and Compare Financing Offers, Affordable luxury car financing options

- Before entering negotiations, make sure to research and compare financing offers from different lenders or financial institutions.

- By having a clear understanding of the current market rates and loan terms, you can leverage this information during negotiations to secure a better deal.

- Compare interest rates, down payment requirements, and any additional fees associated with the financing offers to choose the most cost-effective option.

Leveraging Incentives and Promotions

- Keep an eye out for any incentives or promotions offered by the dealership or manufacturer for luxury car financing.

- These incentives could include cashback offers, low-interest rates, or special financing deals that can help you save money on your luxury car purchase.

- Be sure to inquire about any ongoing promotions and see how you can take advantage of these offers to lower your overall financing costs.

Closing Notes: Affordable Luxury Car Financing Options

In conclusion, navigating the realm of affordable luxury car financing opens up a world of possibilities for driving your ideal vehicle without compromising your financial stability. With the right knowledge and strategies, you can embark on the journey to luxury car ownership with confidence and ease.

For those looking to purchase travel insurance online, it’s important to follow some tips for buying travel insurance online to make an informed decision. Research different providers, compare coverage options, and read reviews to find the best policy for your needs.