Key considerations for car leasing sets the stage for this informative discussion, shedding light on crucial factors to help you make informed decisions when leasing a car. Exploring the nuances of car leasing, this guide aims to provide valuable insights for both novice and experienced individuals in the realm of automotive leasing.

Delving deeper into the intricacies of car leasing, we uncover important aspects that can impact your leasing experience and financial decisions.

Overview of Car Leasing

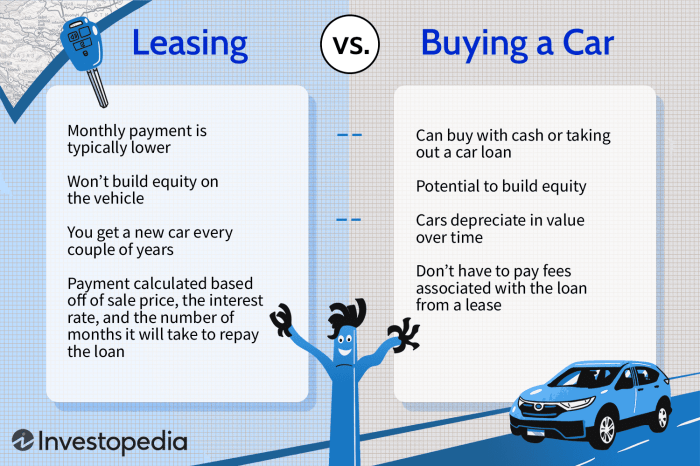

Car leasing is a popular alternative to buying a car, where you essentially rent a vehicle for a set period of time, usually 2-4 years. Unlike buying a car, where you own the vehicle outright after paying off a loan, leasing allows you to use the car for a fixed term while making monthly payments.

Are you looking for some custom car modifications inspiration ideas to personalize your ride? Whether you’re into sleek designs or high-performance upgrades, this article provides a variety of options to suit your taste.

Benefits of Car Leasing, Key considerations for car leasing

- Lower Monthly Payments: Leasing typically comes with lower monthly payments compared to buying a car, as you are only paying for the depreciation of the vehicle during the lease term.

- Lower Repair Costs: Since leased vehicles are usually under warranty, repair costs are often covered, saving you money on maintenance.

- Ability to Drive New Cars: Leasing allows you to drive a new car every few years, giving you access to the latest models and technology without the hassle of selling or trading in a vehicle.

- No Resale Hassles: At the end of the lease, you simply return the car to the leasing company, avoiding the stress of selling a used car.

Key Factors to Consider Before Opting for a Car Lease

- Lease Terms: Understand the lease terms, including mileage limits, wear and tear guidelines, and end-of-lease fees to avoid any surprises.

- Monthly Payments: Compare monthly lease payments with buying a car to ensure it fits your budget and financial situation.

- Resale Value: Consider the depreciation of the vehicle during the lease term and how it may impact the overall cost of leasing.

- Insurance Requirements: Check if the leasing company has specific insurance requirements and factor in insurance costs when budgeting for a lease.

Types of Car Leases: Key Considerations For Car Leasing

When it comes to car leasing, there are two main types of leases that you should be aware of: closed-end lease and open-end lease. Each type has its own set of features and benefits, so it’s important to understand the differences between them before making a decision.

Closed-End Lease

A closed-end lease, also known as a “walk-away lease,” is the most common type of lease for consumers. In this type of lease, you return the car at the end of the lease term and walk away, without any further financial obligations (as long as you haven’t exceeded the mileage limit or caused excessive wear and tear). This type of lease provides predictability and peace of mind, as you know exactly what you’ll owe at the end of the lease.

- Fixed monthly payments

- Set mileage limits

- No obligation to purchase the car at the end of the lease

Example: A closed-end lease would be suitable for someone who wants to drive a new car every few years without the hassle of selling or trading in their current vehicle.

Open-End Lease

An open-end lease is less common and is typically used for commercial leases or luxury vehicles. With an open-end lease, you are responsible for the difference between the residual value of the car (estimated value at the end of the lease) and its actual value when you return it. This type of lease carries more risk for the lessee, as you could end up owing a significant amount if the car depreciates more than expected.

- Variable end-of-lease costs

- No mileage limits

- Potential for additional costs at the end of the lease

Example: An open-end lease might be suitable for a business owner who needs a vehicle for work purposes and is confident in the vehicle’s value retention over time.

Financial Considerations

When considering car leasing, there are several financial aspects to take into account that can significantly impact your overall costs and options. From monthly payments to additional fees, understanding the financial implications of car leasing is crucial in making an informed decision.

Monthly Payments, Down Payments, and Lease Terms

- Monthly payments for a leased car are typically lower than purchasing a car because you are only paying for the depreciation of the vehicle during the lease term.

- Down payments for car leases are usually required upfront and can vary depending on the leasing company and the specific terms of the lease.

- Lease terms refer to the duration of the lease agreement, which can range from 24 to 48 months or more. Shorter lease terms may have higher monthly payments but offer more flexibility.

Credit Scores and Car Leasing Options

- Your credit score plays a significant role in determining your eligibility for a car lease and the terms you are offered. A higher credit score can result in lower monthly payments and down payments.

- Individuals with lower credit scores may still be able to lease a car, but they may face higher interest rates and less favorable lease terms.

Additional Costs

- Mileage limits are set at the beginning of a lease agreement and exceeding these limits can result in additional fees per mile driven. It’s important to estimate your average annual mileage accurately to avoid extra charges.

- Wear-and-tear fees may apply at the end of the lease term if the vehicle shows excessive wear beyond normal use. These fees can add up if the car is not returned in good condition.

Maintenance and Repairs

When it comes to leasing a car, understanding your responsibilities for maintenance and repairs is crucial. Not only can it impact your overall leasing experience, but it can also affect your financial obligations at the end of the lease.

Lessee Responsibilities

- Regular Maintenance: As a lessee, you are typically responsible for keeping up with regular maintenance tasks such as oil changes, tire rotations, and brake inspections. Failure to do so could result in additional charges at the end of the lease.

- Repairs: While most leases come with a manufacturer warranty that covers certain repairs, lessees are usually responsible for any repairs that are not covered under warranty. It’s essential to follow the manufacturer’s guidelines for repairs to avoid unnecessary costs.

Tips for Maintenance

- Follow the Maintenance Schedule: Make sure to adhere to the manufacturer’s recommended maintenance schedule. This not only helps keep the car in good condition but also ensures you don’t incur extra charges for neglecting maintenance.

- Keep Records: Maintain records of all maintenance and repairs performed on the leased vehicle. This documentation may be required when returning the car at the end of the lease.

Advantages of Leasing

- Warranty Coverage: Leasing often comes with the benefit of having the car covered under the manufacturer’s warranty for the duration of the lease. This can help reduce out-of-pocket expenses for certain repairs.

- Predictable Repair Costs: Since leased vehicles are typically new and covered by warranty, lessees can enjoy predictable repair costs during the lease term. This eliminates the uncertainty of unexpected repair bills that may come with owning an older vehicle.

Ultimate Conclusion

In conclusion, understanding the key considerations for car leasing is vital for navigating the complex world of automotive leasing. By keeping these factors in mind, you can make well-informed choices that align with your needs and financial goals.

When it comes to finding the most reliable SUVs for families , safety and comfort are top priorities. From spacious interiors to advanced safety features, these SUVs offer practicality without compromising on style.