Key factors to consider when leasing a car: A Guide to Making Informed Decisions Beginning with Key factors to consider when leasing a car, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

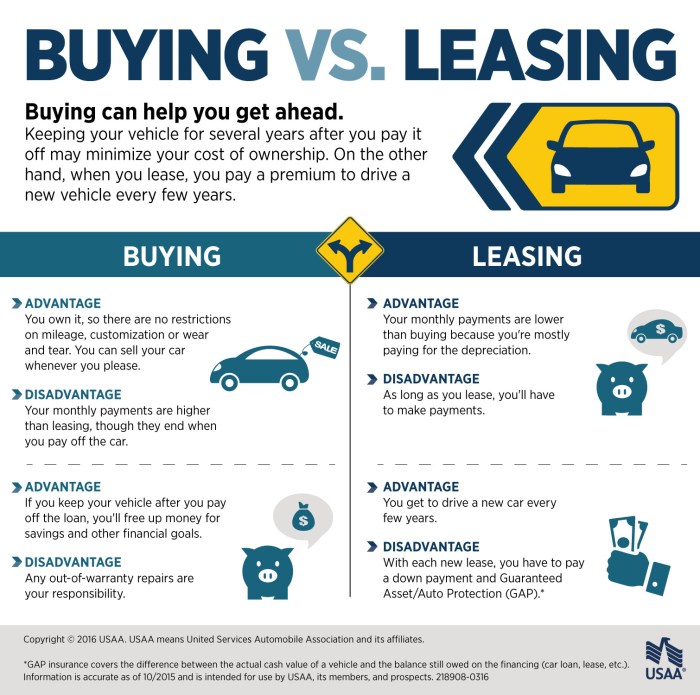

The process of leasing a car involves several crucial considerations that can impact your overall experience and financial commitment. From understanding lease terms to evaluating insurance and maintenance costs, making informed decisions is key to securing the best deal for your needs.

Factors to Consider Before Leasing: Key Factors To Consider When Leasing A Car

Before committing to a car lease, there are several key factors that individuals should consider to ensure they are making a well-informed decision.

Assessing personal financial situation is crucial before entering into a car lease. It is important to evaluate one’s income, expenses, and budget to determine if leasing a vehicle fits within financial capabilities. This includes considering monthly lease payments, insurance costs, and maintenance expenses.

Researching Different Car Models and Lease Terms

When considering leasing a car, it is essential to research different car models and their lease terms. Each car model may have varying lease agreements, including terms such as mileage limits, wear and tear guidelines, and lease-end options. By comparing different models and lease terms, individuals can find the best fit for their needs and preferences.

Impact of Lease Length on Monthly Payments and Overall Costs

The length of the lease term can significantly impact monthly payments and overall costs. Generally, longer lease terms result in lower monthly payments but may lead to higher total costs over the lease term due to additional interest payments. On the other hand, shorter lease terms may have higher monthly payments but could be more cost-effective in the long run. It is important to carefully consider the trade-offs between lease length, monthly payments, and total costs before making a decision.

Understanding Lease Terms

When leasing a car, it is crucial to have a good understanding of the lease terms to make an informed decision. This includes knowing the difference between key concepts such as down payment and capitalized cost reduction, as well as being familiar with common lease terminologies like residual value and money factor. Additionally, understanding the implications of mileage limits and wear-and-tear guidelines can help you avoid any surprises at the end of the lease term.

Difference between Down Payment and Capitalized Cost Reduction

When you lease a car, the down payment is the initial amount you pay upfront to reduce the monthly lease payments. On the other hand, the capitalized cost reduction is a reduction in the overall cost of the vehicle, which can include rebates, trade-in value, or other incentives. It is important to differentiate between these two concepts to accurately assess the total cost of leasing a car.

Common Lease Terminologies

- Residual Value: This is the estimated value of the vehicle at the end of the lease term. A higher residual value can result in lower monthly payments.

- Money Factor: This is similar to the interest rate on a loan and is used to calculate the finance charges on the lease. A lower money factor indicates a better lease deal.

Implications of Mileage Limits and Wear-and-Tear Guidelines

- Most leases come with mileage limits, which can result in additional charges if exceeded. It is essential to estimate your annual mileage accurately to avoid any penalties.

- Wear-and-tear guidelines Artikel what is considered acceptable wear on the vehicle. Any excessive wear may result in additional charges at the end of the lease term.

Evaluating Insurance and Maintenance Costs

When leasing a car, it’s crucial to consider insurance and maintenance costs as part of your overall budget. These factors can significantly impact the total cost of the lease and your financial commitment.

For those who enjoy long drives, having a comfortable SUV is essential. Features like spacious interiors, adjustable seating, and smooth suspension can make your journey more enjoyable. Check out this list of the most comfortable SUVs for long drives to find the perfect ride for your next road trip.

Insurance Premiums for Leased Vehicles

Insurance premiums for leased vehicles may vary compared to owned ones. Leasing companies often require higher coverage limits, which can lead to higher insurance costs. Additionally, leased vehicles may have specific insurance requirements that need to be met, influencing the premium amount.

When it comes to choosing a family-friendly car with advanced safety features, it is important to consider factors such as airbag systems, collision warning technology, and automatic braking systems. You can explore some of the best options available in the market by checking out this list of family-friendly cars with advanced safety features.

Importance of Including Maintenance Costs, Key factors to consider when leasing a car

Including maintenance costs in your budget is essential when leasing a car. Regular maintenance, such as oil changes, tire rotations, and brake inspections, is necessary to keep the vehicle in good condition and avoid potential issues. Ignoring maintenance can result in additional costs or penalties at the end of the lease.

Benefits of Choosing a Lease with Included Maintenance Packages

Opting for a lease with included maintenance packages can provide peace of mind and convenience. These packages typically cover routine maintenance and repairs, ensuring that the vehicle is properly taken care of throughout the lease term. By choosing a lease with maintenance included, you can avoid unexpected expenses and streamline the maintenance process.

Comparing Lease Offers

When comparing lease offers from different dealerships, it is essential to look beyond the monthly payment amount. Consider factors like the total cost over the lease term, mileage limits, and any additional fees or charges. Negotiating factors such as the capitalized cost (the price of the vehicle) and money factor (interest rate) can significantly impact the overall lease deal.

Significance of Negotiating Factors

- Capitalized Cost: This is the price of the vehicle that you are leasing. Negotiating a lower capitalized cost can lower your monthly payments and the overall cost of the lease.

- Money Factor: Similar to an interest rate on a loan, the money factor determines the finance charges on your lease. A lower money factor can result in lower monthly payments.

Manufacturer-subsidized Lease Deals vs. Independent Leasing Companies

- Manufacturer-subsidized Lease Deals:

These are lease offers directly from the vehicle manufacturer. They often come with special promotions, lower interest rates, and incentives. However, they may have stricter terms and limited flexibility compared to independent leasing companies.

- Independent Leasing Companies:

These companies are not affiliated with a specific manufacturer and may offer more flexibility in terms of lease terms, vehicle selection, and negotiating options. However, they may not have the same level of promotions or incentives as manufacturer-subsidized deals.

Final Summary

In conclusion, considering key factors when leasing a car is essential for ensuring a smooth and cost-effective experience. By carefully assessing your financial situation, understanding lease terms, and comparing offers, you can make a well-informed decision that meets your requirements. Stay informed, ask questions, and drive away with confidence in your lease agreement.